Month: October 2017

News

Cyber Risk – The New Insurance Frontier

SMEs, YOU ARE VULNERABLE TO CYBERATTACKS TOO!

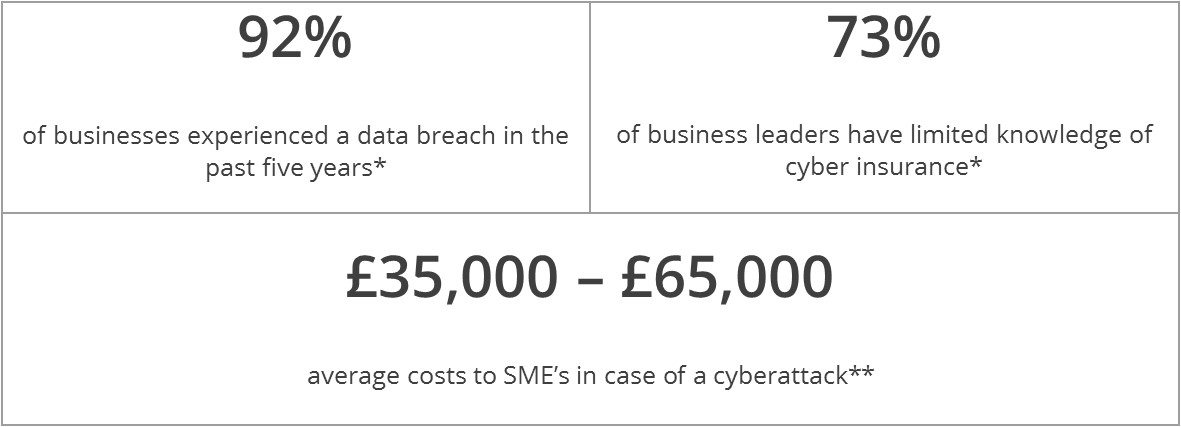

Data breaches aren’t just a big business problem; small and medium-sized businesses with fewer data security resources could be at risk from a cyberattack, ransomware attacks, or data breach by hackers, viruses, or errant employees.

The modern day technology brings with it huge opportunities and for most of the businesses, it’s the only way they can function. But the same technology – the internet – brings with it risks as huge.

If your business relies on technology, data security and the internet in order to operate, protective measures should be in place against invisible threats.

Cyber insurance is designed to provide comprehensive cover, reputation protection and a trusted partner in the event of a claim.

This can cover:

- Cyber business interruption loss

- Privacy breach costs

- Cyber extortion

- Telephone phreaking

- Defamation

- Notifications costs

- Intellectual property

- Hacker damage

- Media liability

- Cyber forensic support

At Citynet Insurance Brokers, we help our retail brokers fully understand the threats faced by their clients and themselves by helping bespoke a product to best suit the need of their individual businesses. As a wholesale insurance Lloyd’s broker, we have access to Lloyd’s market and can deliver the precise, tailored cover needed to protect your business.

Citynet is offering cyber solutions you can rely on for you and your clients’ invisible threats!

- First and third-party coverage

- (including both physical and non-physical risks)

- Stand-alone excess layer policies

- “Introductory” cyber policy products

- Fully bespoke products

- Crisis management services

Our target market includes but is not limited to:

- Professional Service Firms

- Tech companies

- Construction companies

- Media

- Education

- Healthcare Providers & Vendors

- Public Entities

- Retail & Hospitality

- Utilities

- Manufacturing & Wholesale

- SME business through to multinational

It’s important to remember that SMEs need cyber protection just as the large business do.

We’re all vulnerable sooner or later. Get in touch today!

- *Lloyds report: ‘Facing the cyber challenge’, 2016

- **UK Gov Cyber security breaches survey 2017

Read Our Latest Stories

Broker Expo 2024: Meet the Citynet Team

Read More >>The Citynet Cup – Fantasy Football Competition

Read More >>Citynet is launching its brand-new company brochure.

Read More >>News

Do you need Terrorism Insurance? – Citynet can help with that.

Our Terrorism Solutions unique approach is what makes us stand apart from our contemporaries. By working with our broker partners to fully understand the risks faced by their clients, we are able to offer the widest cover at the best possible terms

WHAT DO WE DO?

We arrange all types of Primary and Excess Terrorism Insurance for the UK and International businesses including but not limited to:

- Property and Business Interruption

Public Liability - Employers Liability

- Plant and Machinery

Construction Projects - Denial of Access

WHO IS IT FOR?

We can assist with most businesses requiring terrorism cover including but not limited to:

- Commercial Property Owners

- Businesses with multi locations including international

- Pub and Hotel chains

- Retailers

KEY FEATURES

Price: Competitive premiums and commissions

Location Selection: Select which location you wish to insure and which you do not.

Multi-location exposure: Benefit from the cost saving of a combined PD/BI floating first loss sum insured reflecting the true perception of risk

Overseas Exposures: Cover extends beyond England, Scotland and Wales if required, including Ireland and Worldwide

WE HAVE THE TOOLS, RESOURCES AND THE KNOW-HOW YOU NEED!

For more information, please get in touch.

020 7488 7950

or speak to any of our team members below:

Read Our Latest Stories

Broker Expo 2024: Meet the Citynet Team

Read More >>The Citynet Cup – Fantasy Football Competition

Read More >>Citynet is launching its brand-new company brochure.

Read More >>News

Specialty Insurance cover anyone?

Citynet Specialty Insurance Solutions team understands the complexities of unusual classes of business and are well placed to guide you through the pitfalls and help you to bridge the gaps in a cover that occur in conventional policies.

WHAT DO WE DO?

Citynet Specialty Insurance Solutions team arrange all types of Specialty Insurance for UK and Ireland domiciled businesses, including but not limited to:

- Product Recall

- Accidental Contamination

- Malicious Contamination

- Financial Loss

- Product Guarantee

- Environmental Impairment Liability

WHO IS IT FOR?

Our Specialty solutions are targeted towards all technically complex trades, including but not limited to:

- Foundries

- Wholesale and distribution

- Automotive parts manufacturers

- Food and drink

- General manufacturing

- General and precision engineers

WHY CITYNET?

Knowledge is our key to success!

Choosing the right insurance cover is a very important decision for any business, be it SME or large corporate. As a leading Wholesale Insurance Brokers, Citynet has the ability to evaluate which insurers are the most appropriate for writing a risk, whether it is a complex or distressed risk or just a standard risk where a broker needs a competitive price.

For more information, please contact us or speak to our dedicated team:

020 7488 7950