Category: News

News

Citynet Insurance Brokers appoints Head of Property and Casualty for their UK business.

Established almost two decades ago, wholesaler Citynet Insurance Brokers have appointed industry specialist, Lawrence Shortland as their new UK Head of Property and Casualty.

With over 30 years’ experience within the insurance industry, Lawrence joins from the Wrightsure Group where he has been the Wholesale Director for the last 5 years. He has also previously been a Director at Miles Smith and prior to that worked for RL Davison Lloyd’s Brokers for 18 years where he was the Chief Executive and Managing Director.

In his new role, Lawrence will lead his new team through a new phase of development and growth. The main focus will be expanding the UK account further by nurturing Citynet’s relationships with new and existing intermediaries around the UK as well as helping to develop their facilities with new and existing markets.

Andrew Walsh, Managing Director at Citynet commented: “We are delighted to have an individual of this calibre on board. Lawrence’s experience and track record speak for itself and I am tremendously excited to be working alongside him once again.”

Lawrence Shortland added: “I am thrilled to be joining Citynet, one of the fastest growing and market leading wholesale brokers, and to become part of the exceptional team of people they have there.”

Read Our Latest Stories

Broker Expo 2024: Meet the Citynet Team

Read More >>The Citynet Cup – Fantasy Football Competition

Read More >>Citynet is launching its brand-new company brochure.

Read More >>News

Citynet handle insurance claims differently

When talking about insurance claims, the customer satisfaction is at the heart of any business!

The Consumer Protection Code has at its heart fair outcomes for the client. At the core of this is providing the right advice and the right cover should a claim occur. The Citynet claims team assist their clients with advice on how to reduce the risk of claims and when one does occur they deal with it in the right manner in order that they do get the right outcome.

Having been a major player in the Irish Insurance Market for over 15 years Citynet knows how important it is for their clients to have a fully effective claims service as part of the insurance product that they are purchasing.

To have a fully functioning claims department, the company must be in a position to deliver a positive effect for the insured. “For most of our clients their insurance spend forms a large part of their expenditure for the year and for that to be justified they need to know exactly what product they are purchasing. There is absolutely no point in the placing departments working to achieve a decent result when it is not supported at the time when a claim is reported.

“For those clients who need it, we ensure that the right team is in place to deliver the right result. We consider the company’s insurance history, have they had a poor claims record and if so what contributed to that? What kind of assistance did they receive from their previous insurers? For us to obtain these answers we need to meet with the insured, their retail broker and our nominated loss adjuster. Once we understand their requirements we put in place a bespoke product for the client. What has been surprising is the lack of engagement our clients have received from their previous insurers.

“Insurers do sometimes suffer from poor reputations simply because they do not fully communicate with the insured during the claims process and for Citynet to be an effective intermediary, we needed to put that right” commented Richard Seeley, Claims Director at Citynet Insurance Brokers.

From having the claims process in place for a number of years now, Citynet believes that this type of service not only greatly assists with the handling of a claim but improves the claims record of their clients.

“Without a doubt, we have seen an improvement of clients’ claims records. There are very simple things that they can do to reduce the risk of a claim, but also when that claim does occur we can be in a better position to defend it just by putting in place simple processes. Therefore, we are not only seeing a reduction in the number of incidents that a client may have, but the chances of defending claims have greatly improved. This has a direct financial impact on the insured; The reduction in the number of claims reported not only means fewer payments to cover the cost of their policy excess – they could also see a positive effect on the cost of their renewal premiums.” This is not a complicated idea and it can be done for any type of business no matter how big or small,” adds Richard Seeley.

Property claims represent a fair share in the day to day activity of our team. These claims can really have a direct impact on the insured and their ability to trade. When a company suffers a sizeable property loss, we need to be able to get that company back into a position to trade as soon as possible. Each loss presents its own challenges and we have to deal with them as they appear.

Yes, there is business interruption insurance to cover for the loss of trade for one or two years, but if you lose one customer to a competitor there is no guarantee they will ever return, that threat has to be minimised. As in every business aspect, communication is key particularly when a major loss is experienced. When the insured has the correct information to pass onto their customers, they are in the position where they can minimise any long-term negative effects on their business.

At Citynet, we go the extra mile to achieve the best results for our clients. Our Claims Department has over 75 years’ experience within the claims business and it is this capability and expertise that puts Citynet in the position to deliver a greatly enhanced product to their clients.

Read Our Latest Stories

Broker Expo 2024: Meet the Citynet Team

Read More >>The Citynet Cup – Fantasy Football Competition

Read More >>Citynet is launching its brand-new company brochure.

Read More >>News

Citynet release 2018 half-year results

Citynet Insurance Brokers Limited (“Citynet”), a leading Lloyd’s Broker offering property, casualty, Motor Fleet, PI and various other classes of insurance has issued its interim half-year results for 2018.

Highlights:

- Strong underlying growth across all departments

- Irish Property Casualty 14% increase in turnover

- UK Property Casualty 12% increase in turnover

- Motor Fleet 27% increase in Turnover

- Profit Growth

Summary:

| Half Year 2018 | Half Year 2017 | |

| Total Revenue | £5,869m | £5,119m |

| Adjusted EBITDA | £1.95m | £1.78m |

Comment and Outlook:

The half-year results are now out and Citynet are delighted to have posted its record income figures for the six months to 30th June 2018.

The above results represent a 15% growth in revenue compared to the first six months of 2017. This is an outstanding achievement in a testing marketplace.

Supporting this growth was an outstanding performance by the Motor department. Andy Walsh, former head of Motor and now Managing Director, said: “I am really proud of the whole Citynet team. It shows what hard work can achieve and I look forward to a similar result if not better for the second half of 2018”

Profit for the period, increased by 9% which was a good performance noting that during the first half of 2018, Citynet invested in strengthening its Underwriting department and a proportion of the costs have been recognised in these results. The anticipated increase in revenue from the expanded underwriting team will start flowing in the second half of 2018 onwards.

David Walland, the CFO of Citynet added: “these are a great set of results of which we are very proud, but we are not sitting around patting each other on the back and already have exciting new opportunities in the pipeline for the second half of 2018.”

Read Our Latest Stories

Broker Expo 2024: Meet the Citynet Team

Read More >>The Citynet Cup – Fantasy Football Competition

Read More >>Citynet is launching its brand-new company brochure.

Read More >>News

Cyber breach and how to protect your business

We’ve all heard about the Dixons Carphone cyber breach involving a hacking attempt on 5.9 million payment cards and 1.2 million personal data records.

Whilst Dixons stated that there was no evidence that the cards have been used fraudulently, it has come as a major blow to the business which faces a potential fine under GDPR, especially after the company was already fined £400,000 by the ICO for a data breach as result of a cyberattack in 2015.

One lesson to be learned here is that cyberattacks could have devastating effects, not on just big organisations but the SMEs are equally at risk, so protecting and monitoring your business must be treated as a priority.

To protect your business from Cyber breach, there are few simple steps you need to consider.

-

- Understanding the risks – is often seen as just an IT issue and more often than not, might not be filed in the ‘urgent matters’ category. As a business, you need to understand that hackers do not just use IT infrastructure to infiltrate databases, telephone systems and even printers might offer a window into your system. This is why understanding your requirements and the risks are so important.

- Complex, regularly updated passwords are harder to crack

- Good anti-virus software and spam filters

- Data encryption and security access measures

- Monitoring software should also be considered for reporting any breaches within the time frame set out by GDPR.

- Educating your staff – this is perhaps one of the most important steps that can be taken to prevent cyber breaches. The majority of hacking attempts do come through email. A good staff education on how to deal with these situations is imperative and could prevent a disaster from happening.

- Backing up systems regularly

Reportedly, 46% of UK Businesses identified a cybersecurity breach in the last year, no-one is exempt from cyber threats. Make your network secure by developing and implementing some simple policies and responses. See here the FCA new infographic on how to achieve this.

Cybersecurity doesn’t have to be expensive but one question remains:

Can you really put a price on protection, given the multiple ways hackers can infiltrate your business and the effect a data breach can have? Citynet’s Cyber insurance services might just be your answer.

Find out how we can help protect your and your clients’ businesses against data breach, by simply getting in touch with us.

Read Our Latest Stories

Broker Expo 2024: Meet the Citynet Team

Read More >>The Citynet Cup – Fantasy Football Competition

Read More >>Citynet is launching its brand-new company brochure.

Read More >>News

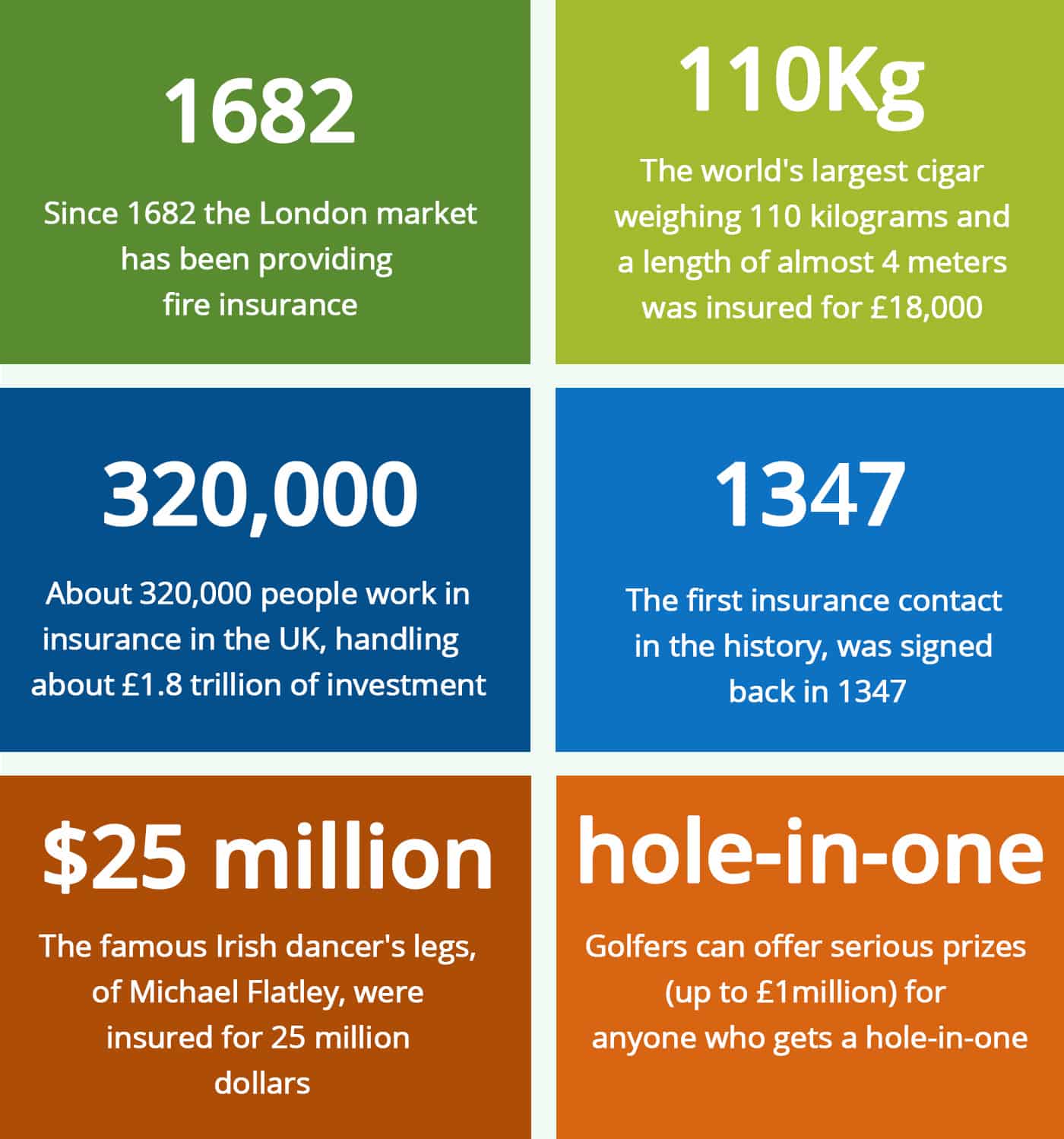

Interesting Facts About Insurance…

1. …since 1682 the London market has been providing fire insurance. A metal plate was attached to their building ensuring that if there was ever a fire their insurance company would fight to extinguish it. If the building wasn’t insured the fire wasn’t put out unless it threatened to spread to an insured building.

2. …the world’s largest cigar weighing 110 kilograms and with a length of almost 4 meters was insured during exposure on one of the exhibitions in London for 18,000 pounds sterling, and the premium was only 50 pence. Perhaps because, as claimed by the owner of a cigar, it can only be smoked in no less than 339 days.

3. …about 320,000 people work in insurance in the UK, handling about £1.8trillion of investment.

4. …the first insurance contract in the history, was signed back in 1347.

5. …the fastest, according to Guinness Book of Records, the famous Irish dancer’s legs, of Michael Flatley, were insured for 25 million dollars.

6. …Today insurance comes in all sorts of shapes and sizes, but perhaps one of the most peculiar policies is ‘hole-in-one’ insurance. Golfers can add ‘big tournament tension’ to their games by offering serious prizes (up to £1million) for anyone who gets a hole-in-one.

7. …British commitment to a range of gambling activities is so strong that “Lloyd” has developed a special insurance policy for insurance of the employer in the event of dismissal of two or more employees, winning the national lottery. According to this policy, the insurer covers the expenses for services incurred by the employer to pay for the recruitment agency.

8. …one of the consequences of the Great Fire of London, which destroyed much of the city 350 years ago, was that it led to the birth of fire insurance and house insurance in general.

The above information is derived from open public sources.

Read Our Latest Stories

Broker Expo 2024: Meet the Citynet Team

Read More >>The Citynet Cup – Fantasy Football Competition

Read More >>Citynet is launching its brand-new company brochure.

Read More >>News

Citynet recognised in ‘1000 Companies to Inspire Britain’ 2018 report

Citynet has featured in the prestigious new London Stock Exchange Group’s 1000 Companies to Inspire Britain.

The fifth annual edition of this report is a celebration of the UK’s fastest-growing and most dynamic Small and Medium Sized Enterprises (SME’s) across the UK and for Citynet to be selected is a real honour and testament to our hard work over the past five years.

As well as identifying 1,000 companies, the annual reports examine in detail the opportunities and challenges facing SMEs and looks at the sectors and trends that will shape the future of the British and European economies.

According to the report, Financial Services is one of the fastest growing sectors with an average annual revenue growth rate of more than 461%, followed by Engineering and Construction at 109%.

To be shortlisted, Citynet needed to show consistent revenue growth over a minimum of three years, significantly outperforming our industry peers.

Citynet is a wholesale Lloyd’s broker and a leading supplier of exclusive schemes and market-leading services to Insurance Intermediaries throughout the UK and Ireland. Our objective is to build a sustainable business that promotes long-term growth over short-term profit.

Having been established for nearly 20 years, we have a significant influence in the London market and pride ourselves on having access to all major carriers. Our highly trained and motivated staff are always ready to deliver the right solutions for the risks we are presented with as well as offering the service we expect ourselves.

Nikhil Rathi, CEO, London Stock Exchange Plc, commented:

“I am delighted to congratulate Richard Scott on the success of his company, which has been recognised in the fifth edition of London Stock Exchange Group’s 1000 Companies to Inspire Britain report, showcasing the UK’s most inspiring and fastest growing companies. We hope the report shines a light on some of the UK’s most vibrant companies, including his. On behalf of London Stock Exchange Group, we thank him for inspiring us.”

Richard Scott, CEO, Citynet Insurance Brokers, commented:

“It is always satisfying for your achievements to be recognised. Our success is as a result of all the hard work our conscientious staff have and continue to put in. All of us at Citynet care deeply about servicing our brokers and it is this passion and commitment which has fuelled our growth in recent years”

A full, searchable database of all of the companies along with a downloadable pdf of the publication can be found online at www.1000companies.com as well as more detail on the methodology.

Read Our Latest Stories

Broker Expo 2024: Meet the Citynet Team

Read More >>The Citynet Cup – Fantasy Football Competition

Read More >>Citynet is launching its brand-new company brochure.

Read More >>News

ABI – TOP TEN KEY FACTS ON UK INSURANCE AND LONG-TERM SAVINGS

Read the full report here: ABI Key Facts

Read Our Latest Stories

Broker Expo 2024: Meet the Citynet Team

Read More >>The Citynet Cup – Fantasy Football Competition

Read More >>Citynet is launching its brand-new company brochure.

Read More >>News

Stage is set for Citynet’s newest product – Entertainment & Leisure

One of the most famous sayings in entertainment is “The show must go on”, but as a business owner in the leisure industry; what insurance measures do you have in place to ensure that the curtain doesn’t come down in the event of an unexpected cancellation or occurrence.

Citynet InsuranceBrokers, a leading wholesale Lloyd’s Broker and provider of specialist services, have announced the launch of a new series of products providing protection to the Entertainment and Leisure industry.

With an unparalleled level of knowledge, the Lloyd’s broker (whose cover also includes property, liability, professional indemnity and motor fleet) have an excellent reputation in understanding UK/Irish laws and regulations, along with their combined experience in launching and running successful affinity partnerships alongside some of the best known brands in the country.

In leisure and entertainment, you’ve got to be prepared for the unexpected. The creative industry as a whole has to work to exceptionally tight deadlines and even tighter budgets, whilst still thinking ‘outside the box’ and producing top class output. Equally, the market strives to exceed customers’ expectations, putting everything into providing the ultimate experience.

“Our entry into the creative industry will provide Citynet with further challenges which is something we thrive on. We pride ourselves on continually improving and increasing our offering to our retail brokers. We strive to be proactive and will always look to stay ahead of our competitors by never resting on our laurels” said CEO, Richard Scott. “The Entertainment and Leisure product we are launching to the UK and Irish market is a clear statement that we want to be the Lloyds Broker of choice for all quality retail brokers in the territories that we trade”

The Entertainment and Leisure sector has become one of the UK’s most lucrative earners – worth an estimated £200 billion to the British economy.

By offering the core cover for amusement arcades, children soft play centres, health and fitness clubs, contingency/cancellation and abandonment including non-appearance (find the full list of trades here), Citynet are well positioned to leverage their experience in complex deals to help cover events and exhibitions that will take place indoor or outdoor, large or small.

“Citynet offers specialised insurance products for the vast world of Entertainment and Leisure together with a refreshingly personal and consistently thorough approach to managing risk. Our core offering is designed to cater for a wide range of Entertainment and Leisure trades on both annual and short period basis. We will provide the highest level of customer service and due diligence to each and every risk we are entrusted with by our clients along with obtaining the best coverage and pricing available.” commented Tim Hicks, Head of Schemes and Specialty Risks at Citynet.

Citynet has chalked up nearly two decades of broking experience, built on understanding how their clients operate and the high-risk issues that are sometimes misunderstood by the insurance market.

“In the last 5 years, we have grown our income 400%. This has been achieved by recruiting first-class producers who know their specialist subjects inside out. Once again we are looking for a record-breaking year in 2018 and with the efforts of all our team we expect to achieve this.” commented Richard Scott.

“In the last 5 years, we have grown our income 400%. This has been achieved by recruiting first-class producers who know their specialist subjects inside out. Once again we are looking for a record-breaking year in 2018 and with the efforts of all our team we expect to achieve this.” commented Richard Scott.

Read Our Latest Stories

Broker Expo 2024: Meet the Citynet Team

Read More >>The Citynet Cup – Fantasy Football Competition

Read More >>Citynet is launching its brand-new company brochure.

Read More >>News

How is the business performing?

The last twelve months have been the most rewarding in our 18-year history. Our continued growth would not be possible without the loyal support of our brokers, underwriters and staff.

Throughout the past year, we have continued to focus on our core activities which are Casualty, Property, Motor Fleet and Professional Indemnity emanating from the United Kingdom, Republic of Ireland and New Zealand. Our business model remains simple, servicing our loyal broker base and continuing to engage daily with our partner insurers.

We are forecasting a healthy double-digit increase again in both turnover and profit for the forthcoming financial year. This is despite a challenging marketplace in which a surplus of capacity means we are still some way from ideal market conditions. The recent Ogden ruling will undoubtedly have an impact on the two largest sectors of our business, Motor and Casualty although I suspect the full impact will be more noticeable in our 2018/19 financial year.

As the company has grown, we have made the necessary corporate and regulatory advances to support that growth, these include the evolution of the risk and compliance, audit and remuneration committees, the addition of a second non-executive director and encouraging a qualified workforce. It is true to say that our culture has changed significantly during recent years.

We have always strived to be the best we can and whilst we are proud of our recent achievements we feel that we have merely laid the foundations for a period of accelerated growth. We are very well placed to use our size and good reputation as a springboard for further success. We will endeavour to improve our service and add to our product offerings as well continue to recruit like-minded individuals during the next twelve months.

Following our acquisition by the PIB group we are in the fortunate position of having a supportive Parent Company behind us, as well as benefitting from their significant influence in the marketplace. All these factors contribute to a feeling of excitement that 2018 will be even better than last year.

Richard Scott, CEO and Andy Walsh, MD

Read Our Latest Stories

Broker Expo 2024: Meet the Citynet Team

Read More >>The Citynet Cup – Fantasy Football Competition

Read More >>Citynet is launching its brand-new company brochure.

Read More >>News

Have you ever thought of changing your Motor Insurance Wholesaler?

Working with a panel of high street and commercial brokers across the UK and Ireland on an “exclusive” basis with NO direct divisions, we are ideally positioned to negotiate attractive terms for your clients.

Citynet Motor Fleet’s quick and efficient service, together with our reputation for tenacity and transparency, gives you the comfort to trust us with your clients’ insurances.